PropNex Picks

|October 14,2025HDB/Resale/EC: Which Home Fits Your Timeline & Cashflow?

Share this article:

Buying a home in Singapore is one of the biggest financial commitments you'll ever make - and it's about far more than just price tags or unit size. The two questions most buyers face are: When can I actually move in? and Can I afford the cash flow along the way? These factors, often overlooked, can make or break your housing journey.

In this guide, we'll break down the three main options - HDB BTO, resale HDBs, and Executive Condominiums (ECs) - with a planner-style approach. You'll learn how each choice impacts your timeline to collect keys, the cash you'll need upfront, and the longer-term financial commitments. By the end, you'll have a clearer view of which path truly fits your lifestyle and budget.

HDB BTOs are generally more affordable and come with government grants, making them an attractive starting point for many young couples. However, the trade-off is time. Buyers usually have to wait three to five years before collecting their keys, and with possible construction delays, this waiting period can stretch even longer. For those who are not in a hurry and prefer lower upfront costs, a BTO may be the right fit, but patience is essential.

Resale HDBs provide the opposite advantage. They are ready within months, allowing buyers to move in quickly and skip the long waiting game. This makes them ideal for families who need immediate housing or those who want certainty in their move-in timeline. On the flip side, resale purchases often come with higher upfront expenses, such as Cash Over Valuation (COV), renovation to refresh older units, and sometimes limited access to housing grants. Buyers who value speed and convenience must be ready to manage these financial demands.

Executive Condominiums (ECs) sit in a unique middle ground between HDB flats and private condominiums. They offer the appeal of private-style living at a subsidised entry price, especially with CPF housing grants available for eligible first-time buyers. While they present good long-term value and capital appreciation potential, ECs do require stronger cash flow management. Buyers must be prepared for higher downpayments and progressive payments during construction if they buy new launches, making ECs more suitable for those who have built a stronger financial foundation.

Option | Time-to-Keys | Notes |

BTO HDB | 3-5+ years | Keys are only available once construction is completed. Delays are possible, which can push the waiting time even longer. Buyers may need to budget for interim renting or continue living with family. |

Resale HDB | 3-6 months | This is the fastest route to moving in. Ideal for families who need housing quickly or want certainty in move-in dates. Buyers must be ready for higher cash outlays such as COV. |

EC (New Launch) | ~3 years | Buyers make progressive payments while waiting for the project to TOP. The timeline is shorter than BTOs but still requires patience and financial stability during the construction years. |

EC (Resale) | 3-6 months | Similar to resale HDBs in speed, offering relatively quick access to private-style living. Suitable for buyers who want to avoid long waits but can manage higher upfront costs. |

Why it matters: Waiting time influences more than just conveniences. It can affect family planning, children's school registration, commuting choices, and even financial opportunity cost. Buyers must consider whether they can afford temporary housing or whether delaying entry into the property market could mean missing out on years of equity growth.

Aspect | HDB BTO | Resale HDB | EC (New Launch) | EC (Resale) |

Upfront Costs | Lower booking fee, grants available; lower initial cash/CPF outlay | Higher initial outlay; possible COV; renovation often needed | Higher booking fee and downpayment; CPF grants apply but cash flow tighter | Similar to resale HDB; higher than BTO but no progressive payment |

Progressive Payments | Payments staggered during construction (3-5 years) | Not applicable; full loan kicks in once completed | Progressive payments during construction (~3 years) | Not applicable; immediate full loan |

Ongoing Costs | Mortgage starts after key collection; renovation cost relatively lower | Mortgage starts quickly; higher renovation cost for older flats | Mortgage repayments increase gradually as construction progresses; renovation depends on unit | Mortgage begins upon purchase; renovation needs vary |

Opportunity Cost | May need to rent during waiting period; equity building delayed | Move in quickly; save on rent and start building equity earlier | May need interim housing until TOP; delayed equity growth | Quick move-in; equity growth begins immediately |

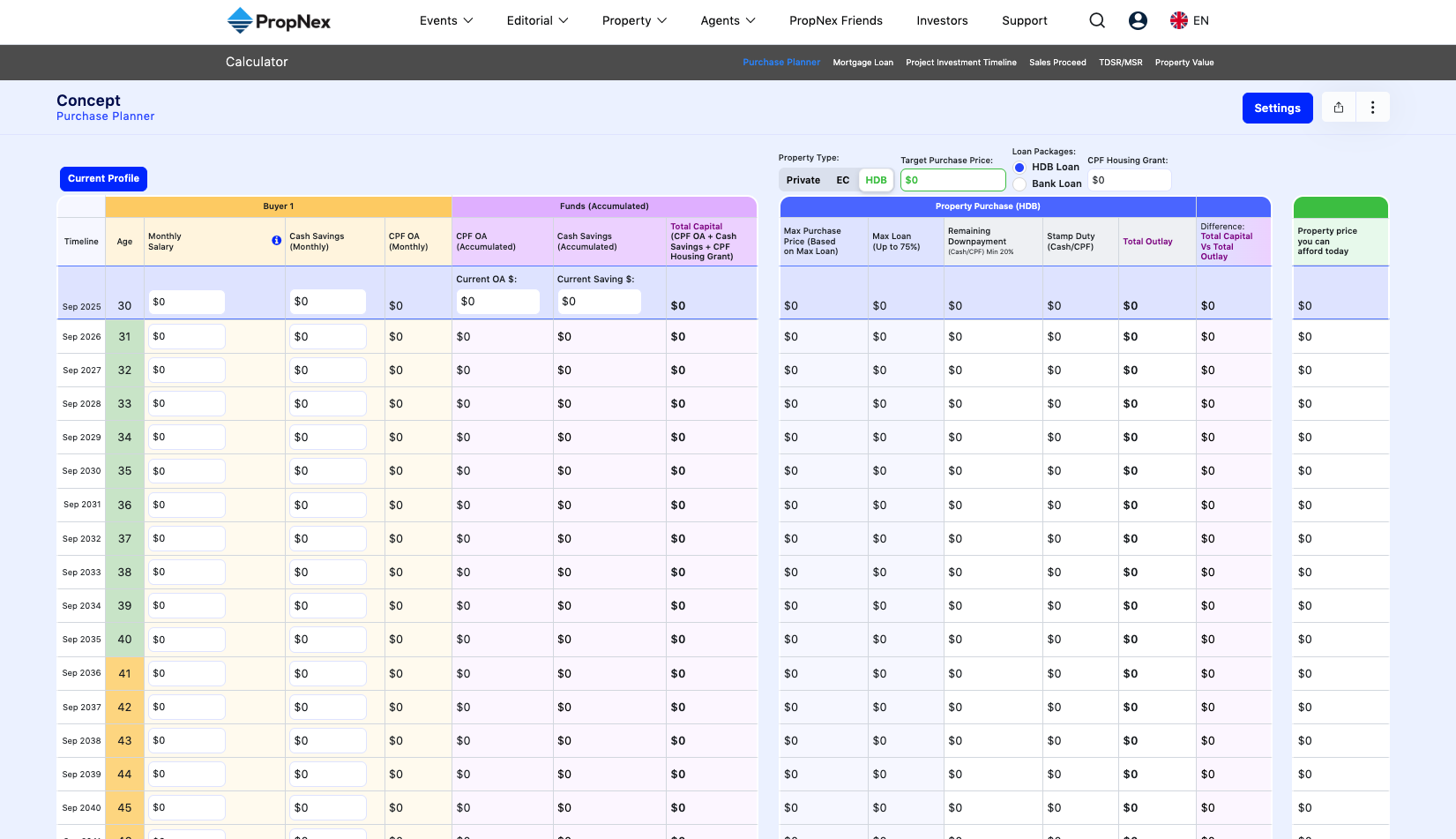

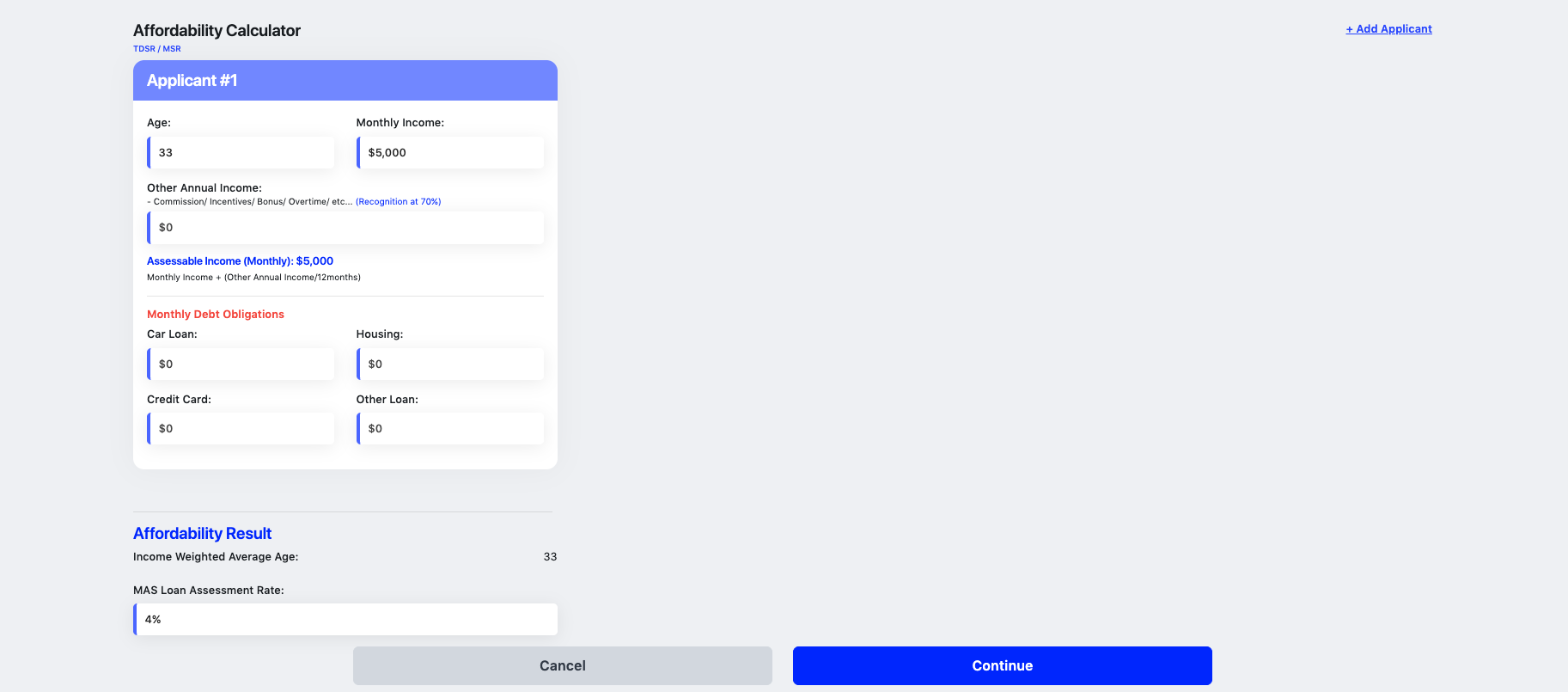

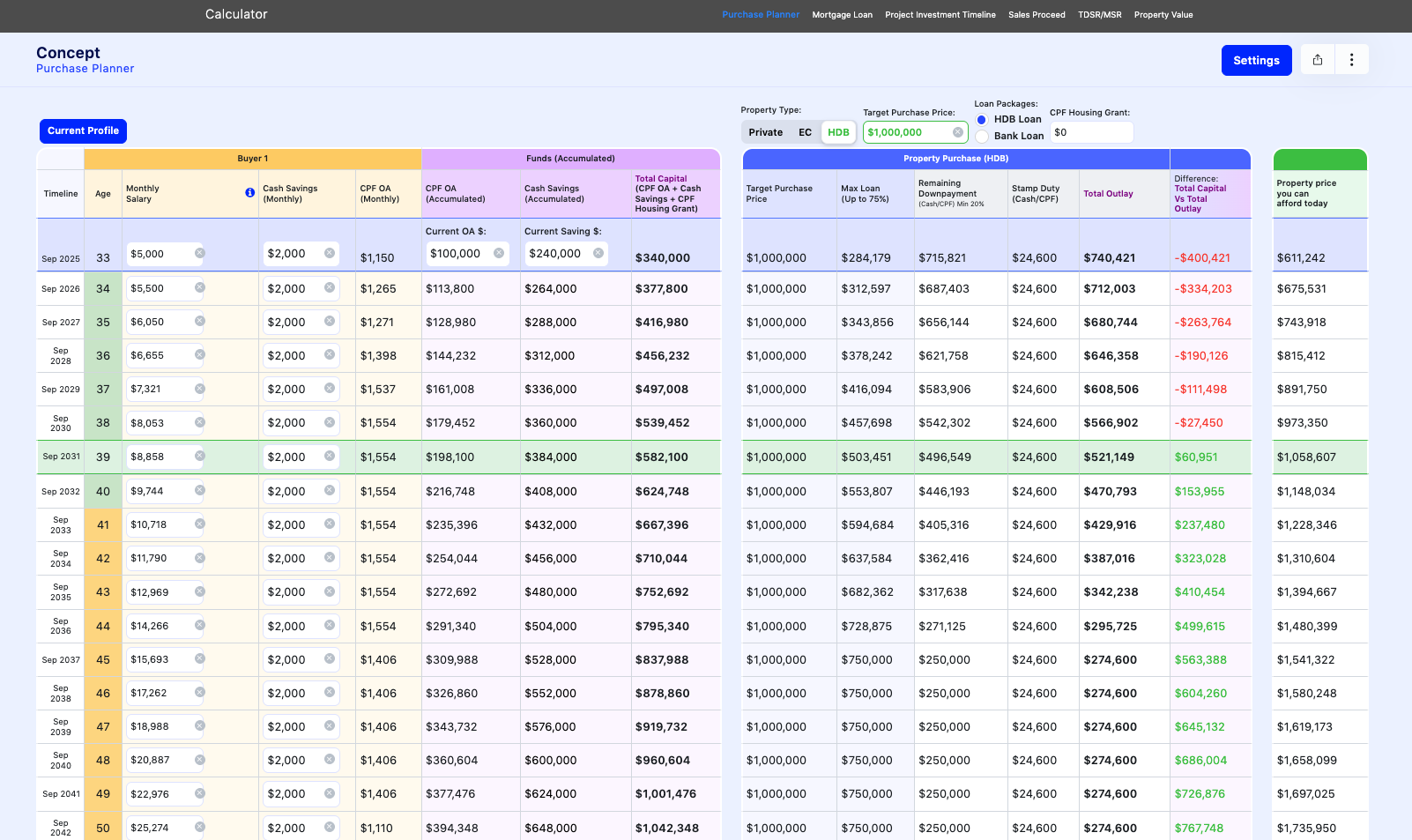

One way to make your decision clearer is by using a cashflow calculator. PropNex offers a comprehensive tool here: Purchase Calculator. With this, you can input your income, CPF usage, and expected grants to project your affordability across the three housing types.

By mapping out different scenarios, buyers can see how each pathway plays out financially over time and gain clarity before committing to a purchase.

Step-by step example: How to use the calculator

1. Head to the Purchase Calculator.

2. Select the property type you are considering (HDB, private, or EC).

3. Key in your household income, CPF balances, and any applicable grants. You can even key in your salary increment percentage.

4. Input the estimated purchase price of the property.

5. The calculator will show you a breakdown of the initial cash/CPF needed, monthly mortgage, and whether you qualify under MSR or TDSR rules.

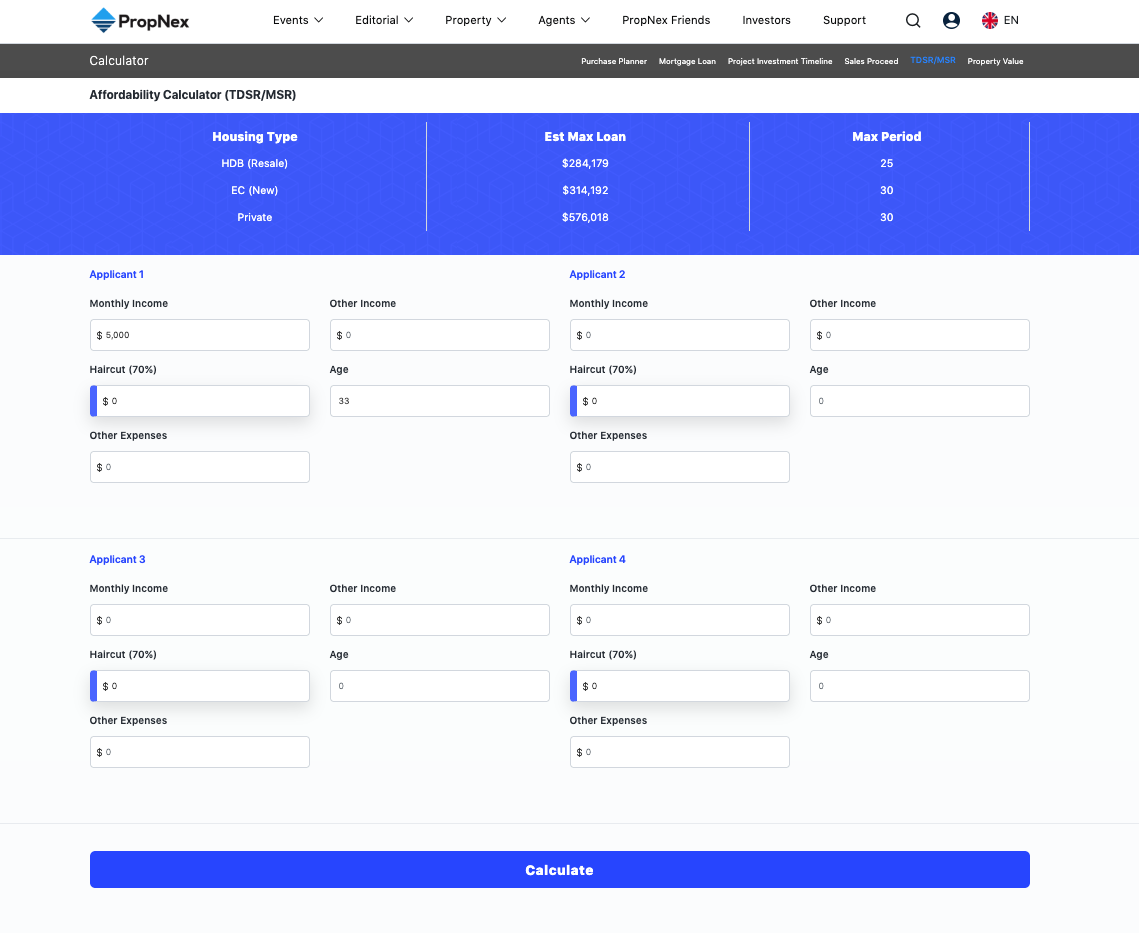

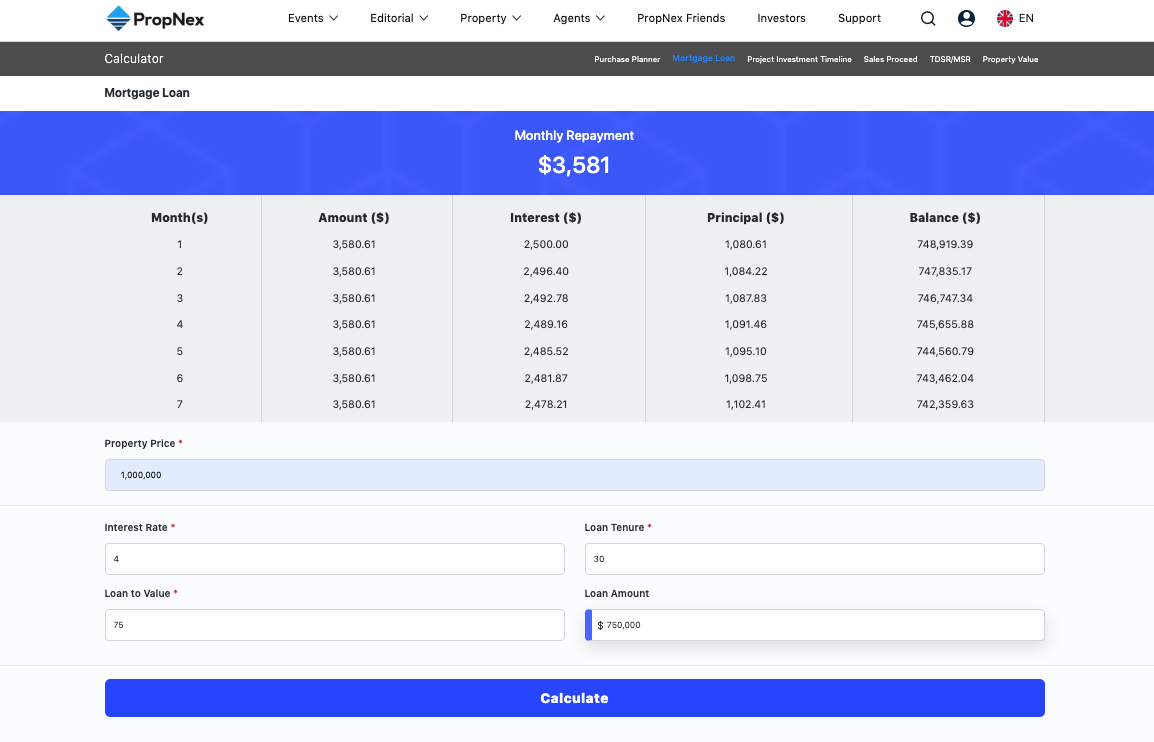

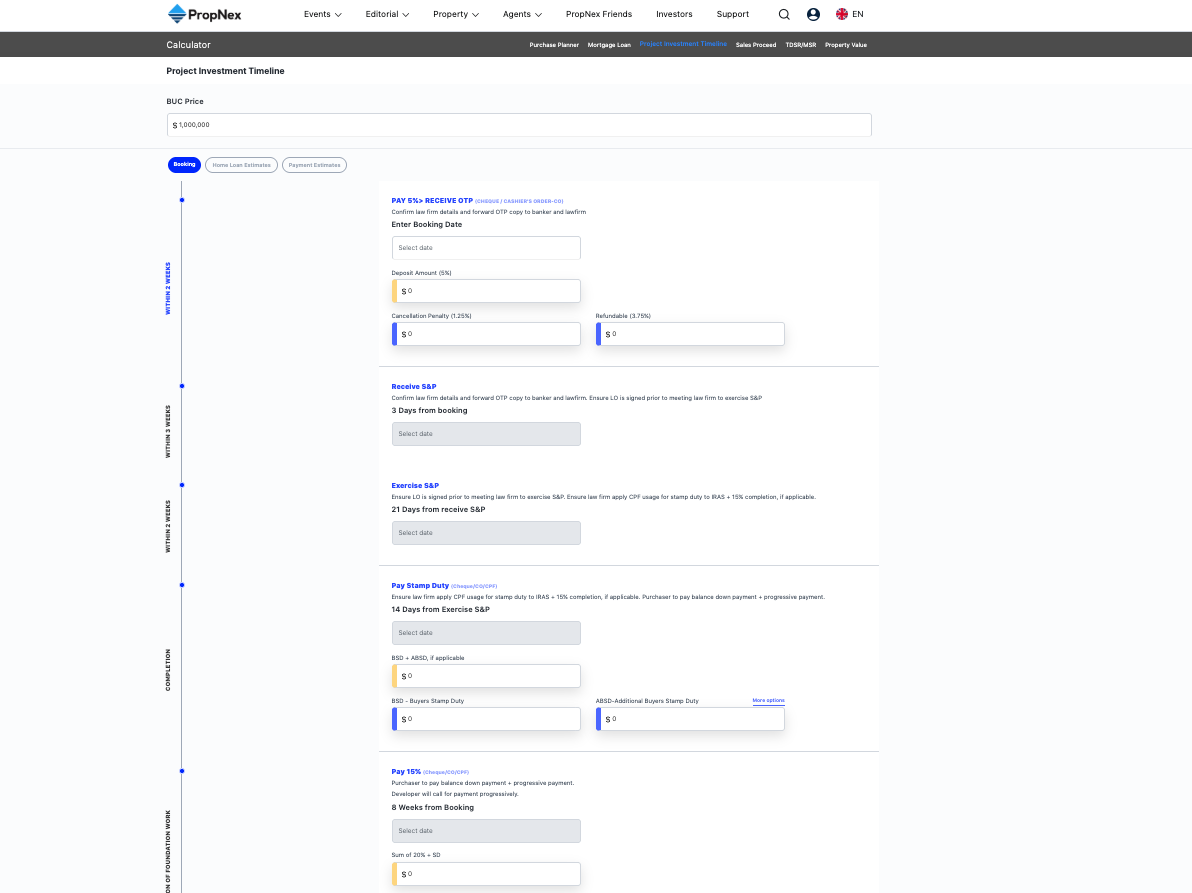

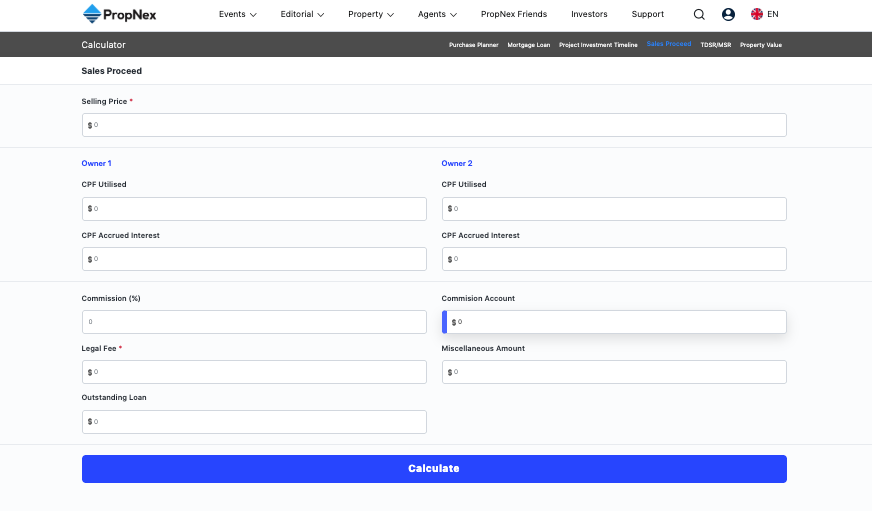

This quick process allows you to immediately compare affordability across different property types and make better-informed decisions. Beyond this, PropNex also provides other calculators to help homeowners plan better, such as the affordability calculator, mortgage loan calculator, project investment timeline, sales proceed calculator, and property valuation tool.

When it comes to choosing between HDBs and ECs, there is no one-size-fits-all answer. Each comes with trade-offs in terms of waiting time, upfront cash, and long-term financial commitments. Ultimately, your decision should align with your lifestyle needs, urgency, and financial health.

To make sense of the numbers and options, consult a PropNex advisor for a personalised plan. You can also explore our related guides on CPF grants, rentvesting strategies, and freehold vs leasehold considerations to sharpen your decision-making.

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.